Okay, so picture this: I'm at a BBQ last summer, right? My buddy Dave, who thinks he's the Wolf of Wall Street because he owns, like, three shares of GameStop, is grilling burgers. He’s bragging about his "investment strategy" (which mostly involves Reddit threads) and how he’s going to retire early on his yacht. Classic Dave. Anyway, someone asks him if he knows the difference between liquidity and solvency. He stares blankly at his spatula. It was…awkward. I mean, knowing the difference isn't just about impressing people at BBQs; it's actually pretty important for understanding how healthy a business is.

Which brings us to the million-dollar question: Which one of the following is a measure of long-term solvency? You've probably seen this on a quiz, maybe even your finance professor threw it at you during a particularly brutal lecture. (Side note: why are finance professors always so intense? Is it the numbers? The risk? The existential dread?) Don't worry, we're going to break it down in a way that even Dave grilling burgers can understand.

Solvency: More Than Just Paying the Bills (Eventually)

Think of solvency as the ability of a company to pay all its debts if it, you know, *had* to. It's not just about meeting your short-term obligations – that's liquidity. Solvency is about long-term financial stability. It's about whether a company can keep its head above water in the long haul, even if things get tough. We're talking years, not just the next quarter.

Liquidity is more about, “Can I pay my bills this month?” Solvency is like, “Can I afford to exist in five years?” Big difference!

The Usual Suspects: Potential Solvency Ratios

Let's say you're faced with a multiple-choice question that looks something like this:

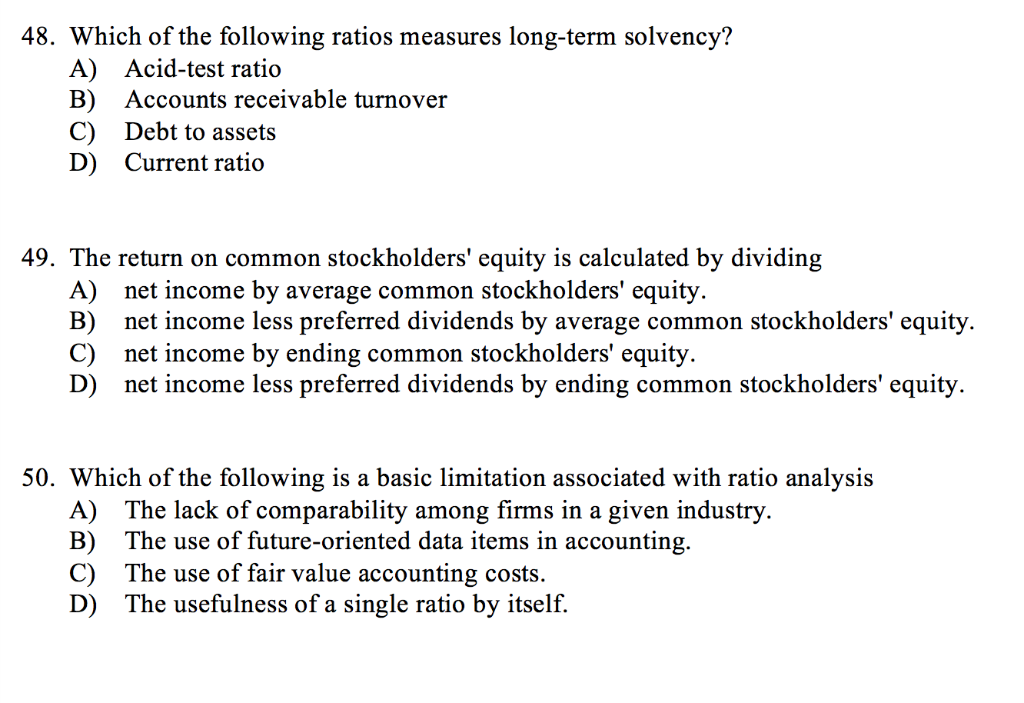

Which of the following is a measure of long-term solvency?

- A) Current Ratio

- B) Quick Ratio

- C) Debt-to-Equity Ratio

- D) Inventory Turnover Ratio

Let's dissect each one, shall we? (Pro tip: eliminating the obvious wrong answers first is *always* a good strategy.)

A) Current Ratio: The Short-Term Specialist

The current ratio measures a company's ability to pay off its current liabilities (debts due within a year) with its current assets (assets that can be converted to cash within a year). The formula is simple: Current Assets / Current Liabilities. A current ratio of 2:1 is generally considered healthy, meaning the company has twice as many current assets as current liabilities.

Is it a solvency ratio? Nope. It’s firmly in the liquidity camp. This is about the next few months, not the next few years. Think of it as checking if you have enough cash on hand to buy groceries this week, not whether you can afford to retire in the Bahamas.

B) Quick Ratio (Acid-Test Ratio): Even *More* Short-Term Focused

The quick ratio is even stricter than the current ratio. It only considers a company's *most* liquid assets – cash, marketable securities, and accounts receivable – and excludes inventory. Why? Because inventory might take a while to sell, and in a pinch, it might not fetch a good price. The formula is: (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities.

Again, this is a measure of liquidity. It's a stress test of immediate cash availability. It’s like checking if you have enough cash in your wallet to pay for dinner tonight, *without* relying on selling your old baseball card collection. (Unless your baseball card collection is worth millions. In which case, congrats! Also, can I borrow twenty bucks?)

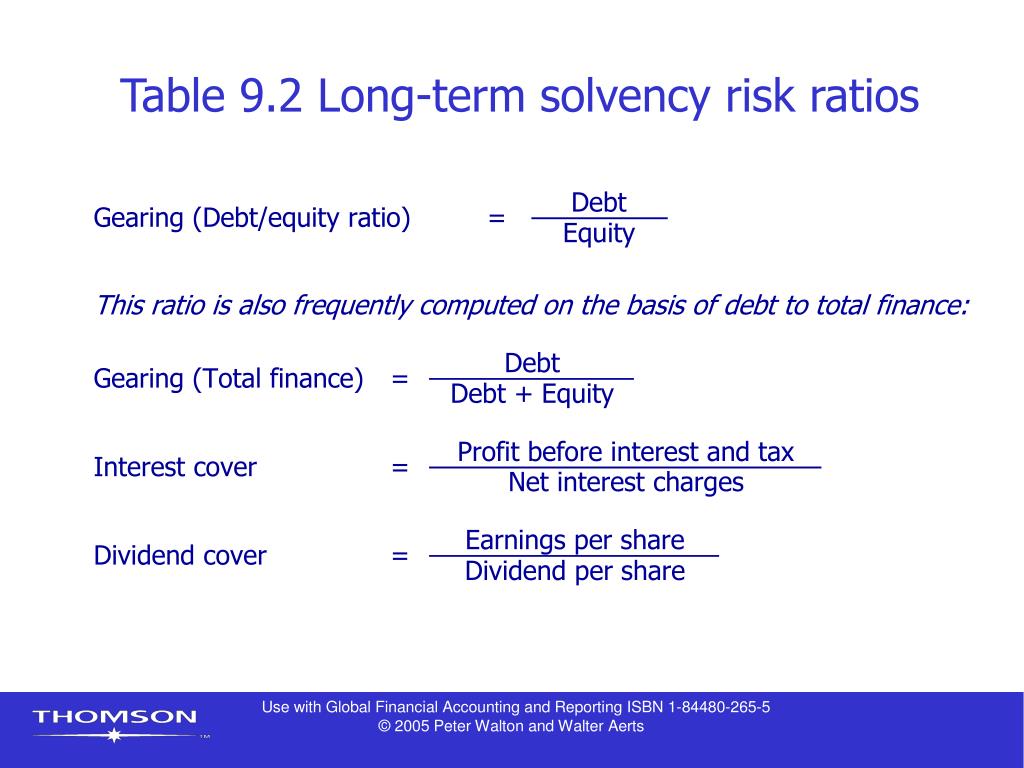

C) Debt-to-Equity Ratio: The Solvency Champion!

The debt-to-equity ratio compares a company's total debt to its shareholder equity. It shows how much a company relies on debt to finance its operations compared to the value of investments made by its owners (shareholders). The formula is: Total Debt / Shareholder Equity. A higher ratio indicates a company is using more debt to finance its assets, which can increase risk.

This is our winner! The debt-to-equity ratio provides insight into a company's long-term financial leverage and its ability to meet its debt obligations over the long run. A high debt-to-equity ratio can indicate that a company is highly leveraged and may have difficulty meeting its debt obligations, which directly impacts its solvency. A low ratio suggests a company is using less debt and more equity, making it generally more solvent.

Think of it this way: are you buying your house with a small mortgage or a huge one? A smaller mortgage (less debt) means you’re more likely to be able to keep up with payments long-term, even if you hit a rough patch. A huge mortgage (more debt) means you’re living on the edge and a sudden job loss could put you in serious trouble. Same principle applies to companies!

D) Inventory Turnover Ratio: Efficiency, Not Solvency

The inventory turnover ratio measures how many times a company sells and replaces its inventory over a period (usually a year). It indicates how efficiently a company is managing its inventory. The formula is: Cost of Goods Sold / Average Inventory.

While inventory management is important, this ratio primarily measures operational efficiency, *not* long-term solvency. A high inventory turnover ratio generally indicates efficient inventory management, while a low ratio might suggest overstocking or slow sales. But it doesn't tell us anything about the company's overall ability to meet its long-term debt obligations.

Imagine a bakery that sells its pastries like hotcakes (high turnover). That’s great for their bottom line, but it doesn’t necessarily mean they’re solvent. They could still be drowning in debt from loans they took out to buy fancy new ovens.

The Verdict: Debt-to-Equity is Your Solvency Ratio

So, the answer is C) Debt-to-Equity Ratio. It's the most direct measure of a company's long-term ability to meet its financial obligations.

Why Solvency Matters (Besides Impressing People at BBQs)

Understanding solvency ratios is crucial for a few key reasons:

- Investor Confidence: Investors use solvency ratios to assess the risk of investing in a company. A solvent company is more likely to generate long-term returns.

- Lender Assessment: Banks and other lenders use solvency ratios to determine whether to lend money to a company and at what interest rate. A more solvent company is seen as a lower risk borrower.

- Financial Health Monitoring: Companies themselves use solvency ratios to monitor their financial health and identify potential problems before they become crises.

- Strategic Planning: Understanding solvency helps companies make informed decisions about investments, debt financing, and other strategic initiatives.

Basically, if you're an investor, a lender, or even just an employee of a company, you need to know if that company is built on a solid foundation or teetering on the edge of financial disaster. Solvency ratios provide a vital piece of that puzzle.

Beyond the Ratio: A Holistic View

While the debt-to-equity ratio is a valuable tool, it's important to remember that it's just one piece of the puzzle. Don't rely solely on one ratio to make investment decisions. Always consider other factors, such as:

- Industry Trends: Solvency ratios can vary significantly across industries. What's considered a healthy debt-to-equity ratio for a tech company might be risky for a manufacturing company.

- Company Management: The quality of a company's management team plays a crucial role in its long-term success. Even a company with a high debt-to-equity ratio can thrive if it's well-managed.

- Economic Conditions: Economic downturns can significantly impact a company's solvency. A company that looks solvent in a strong economy might struggle during a recession.

- Cash Flow: While the debt-to-equity ratio looks at the balance sheet, understanding a company’s *cash flow* is also vital. A company may have high debt, but if it generates strong cash flow, it’s in a better position than one with less debt but weak cash flows.

Think of it like going to the doctor. They don't just take your temperature; they check your blood pressure, ask about your symptoms, and consider your medical history. Analyzing a company's solvency is similar – it requires a comprehensive assessment.

So, the next time you're at a BBQ…

…and someone starts bragging about their "amazing" stock picks, casually drop the term "debt-to-equity ratio" into the conversation. You'll sound super smart, and you might even prevent them from making a disastrous investment. (Or, at the very least, you'll have a good story to tell later.) More importantly, you'll be armed with the knowledge to make informed decisions about your own financial future. Now go forth and conquer the world of finance! (And maybe grab a burger while you're at it.)

.jpg)