Whole Foods Market Inc. was a publicly traded company whose stock price was a key indicator of its financial health and investor confidence. However, it's crucial to understand that Whole Foods Market Inc. is no longer a publicly traded entity. It was acquired by Amazon in 2017. Therefore, directly tracking a "Whole Foods Market Inc. stock price" is impossible in the present day. Instead, its performance is now reflected within Amazon's (AMZN) overall financial results.

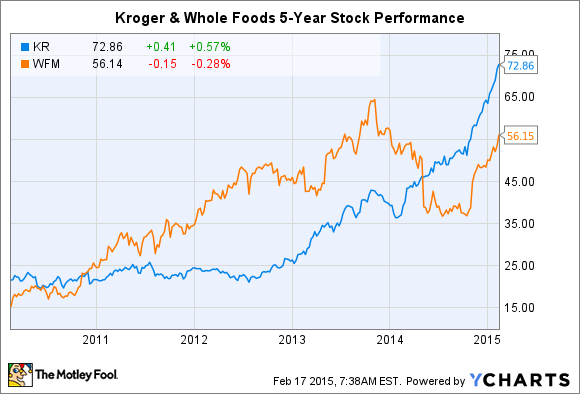

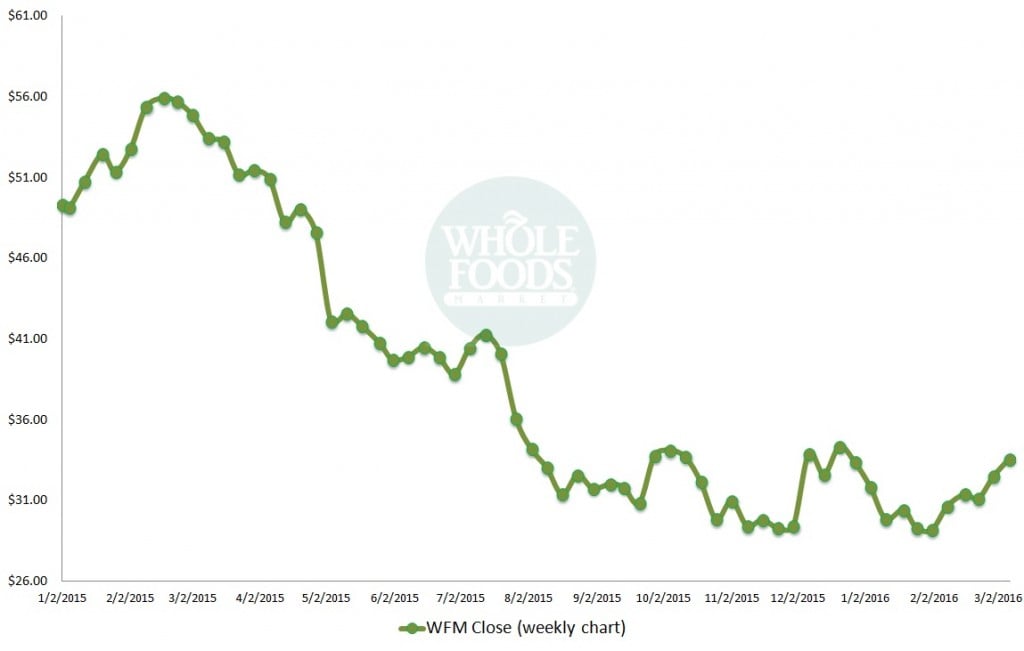

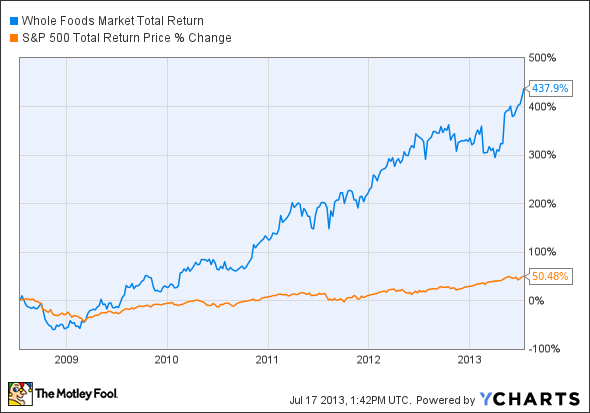

Historical Stock Performance (Prior to Acquisition)

Before its acquisition, the stock price of Whole Foods Market Inc. (traded under the ticker symbol WFM) was subject to the typical forces influencing publicly traded companies. These included:

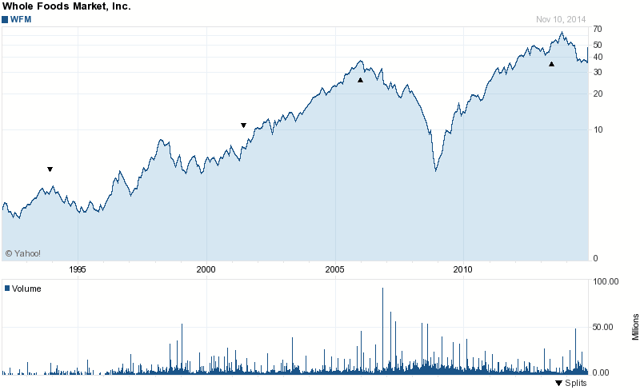

- Overall Market Conditions: Broad economic trends, bull or bear markets, and investor sentiment significantly impacted WFM's price.

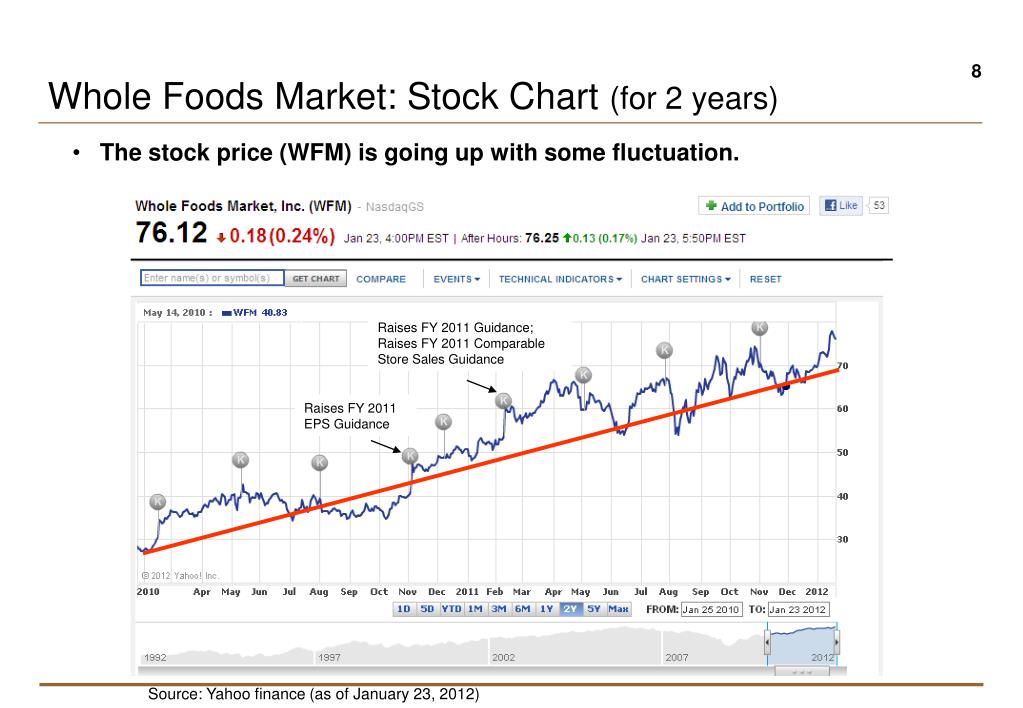

- Company Performance: Revenue growth, profitability, same-store sales, and expansion plans all directly influenced investor perception of the company's value. Positive financial results generally led to stock price appreciation, while disappointing results could trigger a decline.

- Industry Trends: Changes in the grocery industry, such as the rise of organic and natural foods, competition from other grocery chains (both conventional and specialized), and shifts in consumer preferences, affected Whole Foods' stock.

- Analyst Ratings and Reports: Investment analysts regularly issued reports and ratings on WFM, offering their perspectives on the company's prospects. Upgrades often spurred buying activity, while downgrades could lead to selling pressure.

- Major News Events: Company-specific news, such as product recalls, executive leadership changes, or regulatory issues, could create volatility in the stock price. Acquisition rumors or actual offers had a particularly pronounced effect.

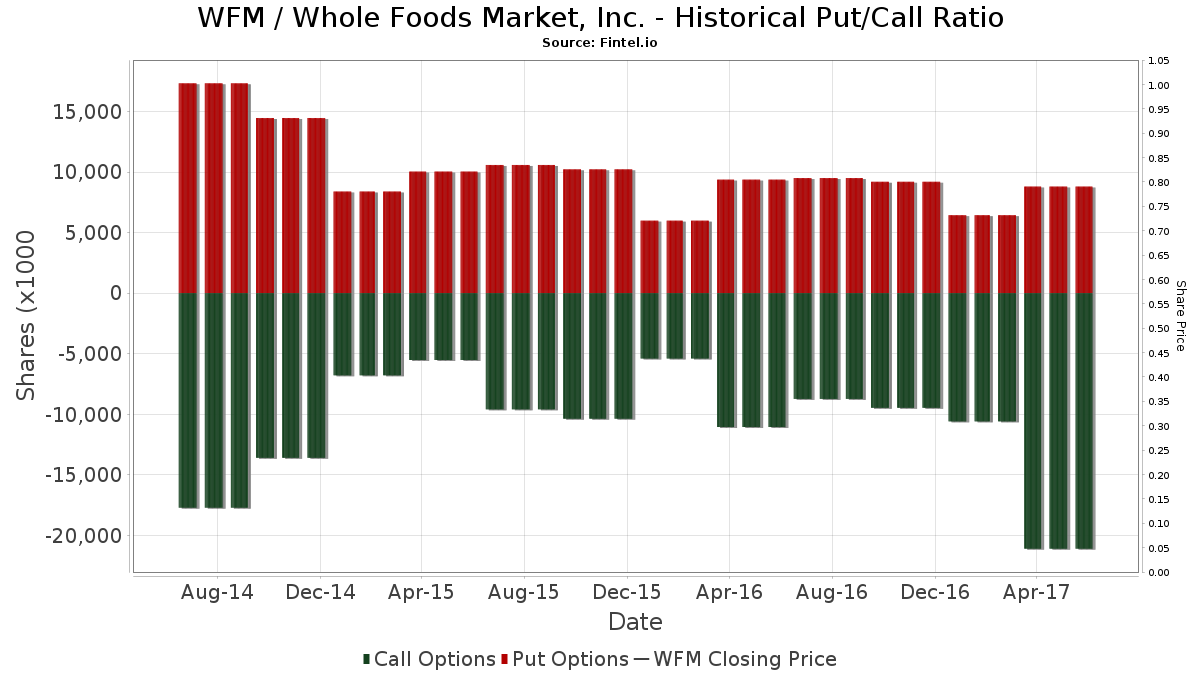

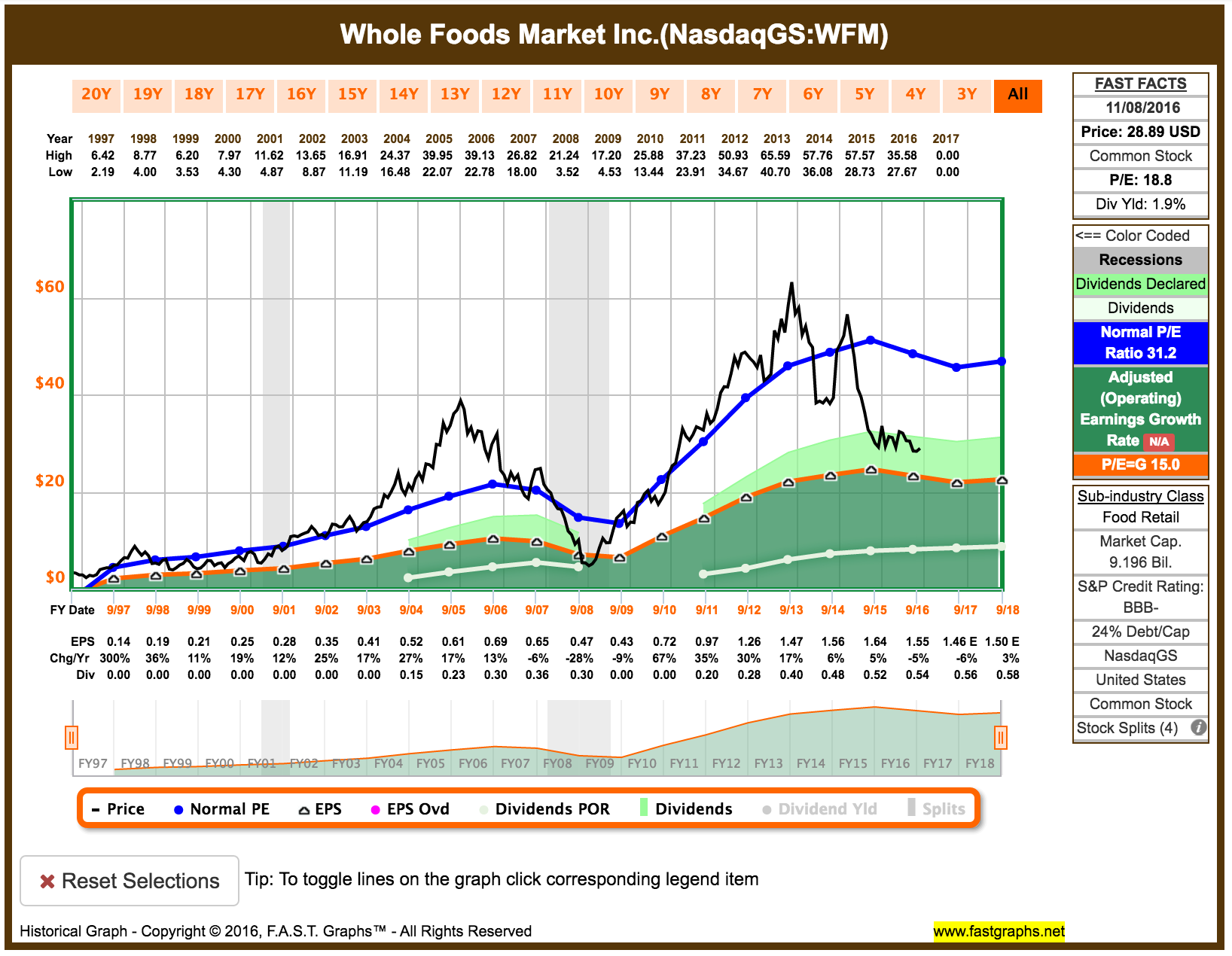

Analyzing historical WFM stock charts would reveal periods of significant growth, consolidation, and potential downturns. These fluctuations were often correlated with the factors listed above. For instance, strong quarterly earnings reports typically resulted in a jump in the stock price, while concerns about increased competition might have led to a period of decline.

Key Metrics to Consider (Pre-Acquisition)

Investors who followed WFM before its acquisition likely paid close attention to several key financial metrics:

- Earnings per Share (EPS): A measure of a company's profitability, EPS indicates how much profit is allocated to each outstanding share of stock.

- Price-to-Earnings (P/E) Ratio: This ratio compares a company's stock price to its earnings per share. A high P/E ratio might suggest that investors have high expectations for future growth.

- Revenue Growth: The rate at which a company's revenue is increasing (or decreasing) over time. Consistent revenue growth is generally a positive sign.

- Same-Store Sales: This metric tracks the sales performance of stores that have been open for at least a year. It provides insight into a company's ability to drive organic growth.

- Profit Margin: A measure of a company's profitability, calculated as net income divided by revenue. Higher profit margins indicate that a company is efficient at controlling its costs.

The Acquisition by Amazon

In June 2017, Amazon announced its agreement to acquire Whole Foods Market for $13.7 billion. This acquisition marked a significant shift in the grocery industry and had a profound impact on Whole Foods' operations and its stock. The acquisition was completed in August 2017, at which point WFM stock was delisted from the NASDAQ stock exchange.

The acquisition price represented a premium over Whole Foods' then-current stock price. This premium reflected Amazon's assessment of Whole Foods' strategic value, including its brand, customer base, and physical store locations. For Whole Foods shareholders, the acquisition provided an opportunity to realize a return on their investment.

"This partnership presents an opportunity to maximize value for Whole Foods Market’s shareholders, while at the same time extending our mission and bringing the highest quality, experiences, convenience and innovation to our customers." - John Mackey, former CEO of Whole Foods Market (on the acquisition announcement).

Following the acquisition, Amazon implemented several changes at Whole Foods, including price reductions, integration with Amazon Prime, and the introduction of new technologies such as online ordering and delivery. These changes aimed to improve the customer experience and drive sales growth.

Impact of Whole Foods on Amazon's Stock (AMZN)

While you can no longer directly invest in Whole Foods Market Inc., its performance is now intrinsically linked to Amazon's overall financial results. Therefore, investors interested in the performance of the Whole Foods business must consider the performance of Amazon's stock (AMZN).

It is challenging to isolate the specific impact of Whole Foods on Amazon's stock price due to the size and diversification of Amazon's business. However, the grocery segment, which includes Whole Foods, is reported within Amazon's overall financial statements. Analysts often provide commentary on the performance of this segment and its contribution to Amazon's total revenue and earnings.

Factors to consider when assessing the impact of Whole Foods on AMZN include:

- Grocery Sales Growth: Tracking the growth of Amazon's grocery sales provides insight into the performance of the Whole Foods business.

- Profitability of the Grocery Segment: Monitoring the profitability of Amazon's grocery segment helps to understand the financial contribution of Whole Foods.

- Strategic Initiatives: Analyzing Amazon's strategic initiatives related to Whole Foods, such as store expansion, technology integration, and marketing campaigns, can provide clues about the company's expectations for the business.

- Competitive Landscape: Understanding the competitive dynamics of the grocery industry and how Whole Foods is positioned relative to its competitors is important for assessing its long-term prospects within Amazon.

Keep in mind that Amazon's stock price is influenced by a wide range of factors beyond the performance of Whole Foods. These include the performance of its e-commerce business, cloud computing division (Amazon Web Services), advertising revenue, and overall economic conditions.

Accessing Information on Amazon's Grocery Segment

Information about Amazon's grocery segment can be found in several sources:

- Amazon's Quarterly and Annual Reports: Amazon releases detailed financial reports on a quarterly and annual basis. These reports provide information about the company's revenue, expenses, and profits, including breakdowns by segment.

- Earnings Calls: Amazon's management team holds conference calls with analysts following the release of each quarterly report. These calls provide an opportunity for analysts to ask questions about the company's performance and strategy.

- Financial News Outlets: Major financial news outlets, such as the Wall Street Journal, Bloomberg, and CNBC, regularly report on Amazon's performance and provide analysis of its various business segments.

- Investment Research Reports: Investment banks and research firms publish reports on Amazon, offering their perspectives on the company's prospects and valuation.

Conclusion

While the Whole Foods Market Inc. stock price (WFM) is no longer directly trackable due to its acquisition by Amazon in 2017, understanding its historical performance and the factors that influenced it provides valuable context. Today, the performance of the Whole Foods business is embedded within Amazon's overall financial results. Investors interested in the grocery segment must now analyze Amazon's financial reports, listen to earnings calls, and follow industry news to gauge the impact of Whole Foods on AMZN stock. This information matters because it provides insights into the dynamics of the grocery industry and the strategic direction of one of the world's largest companies.