Alright, settle in, grab your metaphorical coffee, because we're about to dive into the wild, wacky world of pharmaceutical stock crashes. Specifically, we're dissecting the mystery of why Tonix Pharmaceuticals stock decided to take a nosedive. Think of it as a financial roller coaster, except nobody screamed "whee!" on the way down.

Now, I'm no financial guru (my investment strategy mostly involves picking stocks based on how cool their logos are. Spoiler alert: it's not working.), but I can piece together a story. And trust me, this story involves more plot twists than your average daytime soap opera.

The Tonix Tale: A Brief History (with Exaggerations)

First, a little backstory. Tonix Pharmaceuticals, as the name implies, is in the business of making... well, pharmaceuticals! They're focused on developing medications for things like central nervous system disorders and infectious diseases. So, generally important stuff. They’re like the Avengers, but instead of fighting Thanos, they’re battling insomnia and long COVID. A slightly less exciting, but arguably more necessary, battle.

For a while, things were... okay. Not spectacular, but not disastrous. Think of it as lukewarm coffee. Perfectly acceptable, but not exactly going to write home about. Then, things got interesting. Or, rather, uninteresting, depending on your perspective.

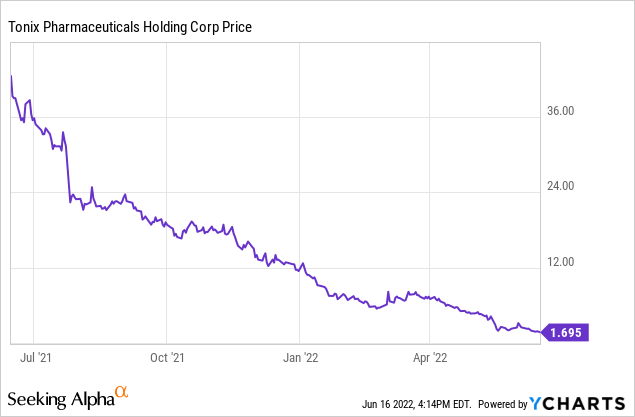

The Drop: What Actually Happened?

So, why the plunge? Well, there's no single, definitive answer, which is what makes this so delightfully frustrating. But here are a few possible culprits, presented with the appropriate level of dramatic flair:

- Clinical Trial Troubles: This is often the biggest baddie in these situations. Pharmaceutical companies live and die by their clinical trials. If a trial fails, or even just underperforms, investors tend to scatter like cockroaches when the lights come on. Maybe their drug for a specific ailment didn’t work as well as hoped. Imagine pouring your heart and soul into baking a cake, only to have it come out looking like a hockey puck. Disappointing, right? For Tonix, there may have been questions about the efficacy or the progress of one or more of their key trials.

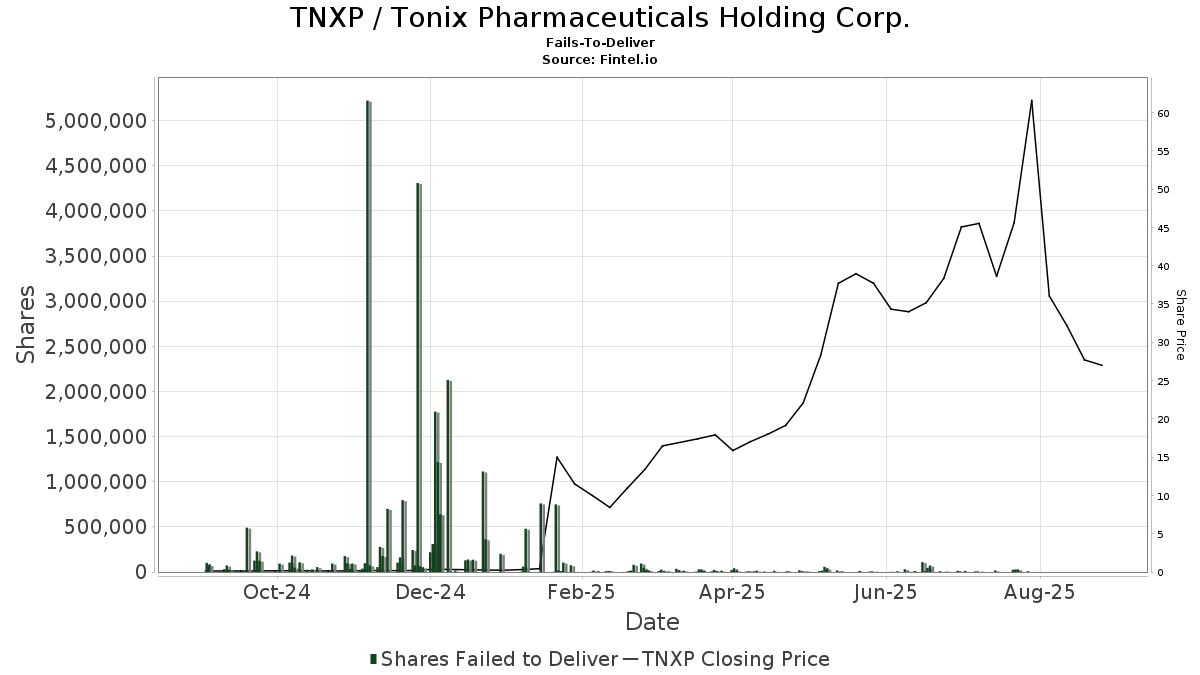

- Dilution Blues: Sometimes, companies issue more stock to raise money. This is called dilution. It's like adding water to your orange juice – you get more juice, but it's less potent. Existing shareholders' holdings become less valuable. Imagine dividing a pizza amongst more and more friends. Eventually, everyone just gets a sad little sliver. Tonix, like many biotech companies, sometimes needs to raise cash, and dilution can be a side effect.

- Market Mayhem: The overall stock market can be a fickle beast. Sometimes, it's up; sometimes, it's down. And sometimes, it just decides to collectively panic for no apparent reason. If the broader market is having a bad day, smaller companies like Tonix can get dragged down with the tide, even if they haven't done anything particularly wrong. Blame it on market jitters!

- The "Meh" Factor: Sometimes, there's no dramatic scandal or catastrophic failure. Sometimes, investors just lose interest. Maybe the company wasn't generating enough buzz. Maybe their investor presentations were snooze-fests. Maybe their marketing campaign involved too many stock photos of people smiling unnaturally. Whatever the reason, a lack of investor enthusiasm can send a stock price south faster than you can say "quarterly earnings report."

- Competition Creep: The pharmaceutical world is a cutthroat place. There are always other companies vying for the same market share, developing similar drugs. If a competitor releases positive news about their product, it can cast a shadow on Tonix and their prospects, causing investors to jump ship. Think of it as a celebrity feud, but with scientific data instead of Twitter insults.

Digging Deeper: Specific Tonix Challenges

While the above are general reasons, let's look at some things potentially specific to Tonix:

- Pipeline Progress: Were there any delays in the development of their pipeline drugs? Were they facing regulatory hurdles? The FDA can be a tough crowd. Getting a drug approved is like trying to convince a grumpy cat to cuddle – it takes patience, persistence, and possibly a bribe of catnip.

- Cash Burn Rate: Developing drugs is expensive. Really expensive. Tonix needs cash to fund its research and development. If investors are worried about the company running out of money, they might sell their shares. Imagine your bank account slowly dwindling after a particularly extravagant vacation. Panic sets in, right?

- News Vacuum: Silence can be deafening. If Tonix wasn't putting out enough press releases or providing updates on its progress, investors might have gotten nervous and assumed the worst. It's like when your friend stops texting you back – you immediately assume they've been abducted by aliens.

The Aftermath: What Now?

So, the stock dropped. The question is: what happens next? Well, nobody knows for sure. (Except maybe some highly caffeinated day traders, but they're probably too busy refreshing their screens to tell us).

Here are a few possibilities, ranging from "happy ending" to "total disaster":

- The Phoenix Rises: Tonix could pull a rabbit out of a hat, announce some groundbreaking results, and the stock could rebound. It's happened before! This is the Hollywood ending, where the underdog triumphs against all odds.

- Steady as She Goes: The stock could stabilize and slowly recover over time. This is the more realistic scenario, where the company focuses on execution, delivers on its promises, and gradually regains investor confidence. It’s like slowly rebuilding a sandcastle after a rogue wave.

- The Acquisition Angle: A larger pharmaceutical company might swoop in and acquire Tonix, recognizing the value in their pipeline drugs. This is the "white knight" scenario, where a knight in shining armor rescues the damsel in distress (or, in this case, a struggling biotech company).

- The Long, Slow Decline: Sadly, the stock could continue to decline. This is the worst-case scenario, where the company struggles to raise capital, faces regulatory setbacks, and ultimately fails to deliver on its promises. It’s like watching your favorite plant slowly wither and die because you forgot to water it. (Don't worry, it's only a metaphor!).

Disclaimer (the Boring But Necessary Part)

Disclaimer: I am not a financial advisor, and this is not financial advice. Investing in the stock market is inherently risky, and you could lose money. Please do your own research and consult with a qualified professional before making any investment decisions. Basically, don't blame me if you lose your shirt. I'm just a humble writer trying to make sense of the crazy world of stock market fluctuations.

The Moral of the Story?

The story of Tonix's stock drop is a reminder that investing in biotech is a rollercoaster. There are highs and lows, twists and turns, and moments where you might want to throw up your hands and scream. But it's also a fascinating world, full of innovation, potential, and the occasional dramatic stock crash. So, buckle up, do your research, and try to enjoy the ride... even when it's terrifying.

And remember, sometimes, even the coolest logos can't save you.