Green Thumb Industries (GTBIF), a prominent player in the burgeoning cannabis industry, has experienced a noticeable decline in its stock price. Understanding the factors contributing to this downturn is crucial for investors and anyone interested in the cannabis market. This article delves into the various reasons behind GTBIF's stock performance, providing a comprehensive overview of the challenges and headwinds faced by the company and the wider industry.

Industry-Wide Challenges

The cannabis industry as a whole has been facing significant headwinds, creating a difficult environment for all companies, including Green Thumb Industries. These challenges are both macroeconomic and specific to the cannabis market.

Macroeconomic Factors

The broader economic climate plays a significant role in the performance of any stock, and cannabis companies are no exception. Rising interest rates, inflation, and concerns about a potential recession all contribute to investor unease. When interest rates rise, borrowing becomes more expensive, which can hinder expansion plans for companies like Green Thumb that rely on capital investments. Inflation erodes consumer spending power, potentially impacting sales in discretionary sectors like cannabis. The fear of a recession leads investors to become risk-averse, often shifting away from growth stocks like those in the cannabis industry and towards safer assets.

Cannabis Market Over Supply

In several key markets, particularly those that have legalized recreational cannabis, oversupply has become a pressing issue. When supply outstrips demand, prices fall, squeezing profit margins for producers. This oversupply is often a result of liberal licensing policies and the rapid expansion of cultivation facilities. The resulting price compression can significantly impact the revenue and profitability of companies like Green Thumb, forcing them to compete more aggressively on price.

Regulatory Hurdles and Delays

The cannabis industry is heavily regulated, and regulatory changes can have a profound impact on companies' operations. Delays in licensing approvals, changes in tax policies, and evolving regulations regarding product testing and labeling can all create uncertainty and increase compliance costs. These regulatory hurdles can slow down expansion plans, restrict market access, and ultimately affect revenue growth. The lack of federal legalization in the United States continues to be a major impediment, preventing cannabis companies from accessing traditional banking services and raising capital more efficiently.

“The regulatory landscape is constantly evolving, creating both opportunities and challenges for cannabis businesses. Navigating these complexities is crucial for long-term success.”

Company-Specific Factors

While industry-wide challenges are a significant contributor, company-specific factors also play a role in Green Thumb Industries' stock performance. These factors relate to the company's financial performance, operational efficiency, and strategic decisions.

Profitability Concerns

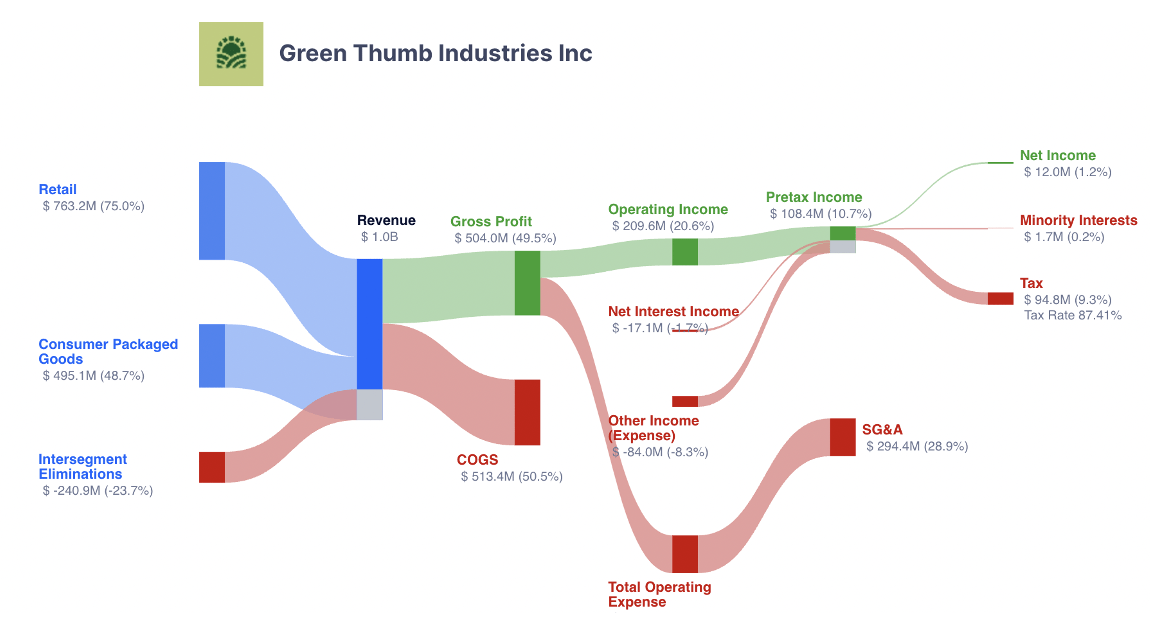

Despite generating substantial revenue, achieving consistent profitability remains a challenge for many cannabis companies, including Green Thumb. While Green Thumb has demonstrated progress in improving its bottom line, concerns about profitability persist. Investors are closely scrutinizing the company's ability to manage costs, optimize operations, and generate sustainable profits. The high cost of goods sold, operating expenses, and interest expenses can all weigh on profitability.

Competition

The cannabis industry is becoming increasingly competitive, with new players entering the market and existing companies expanding their operations. This intensified competition puts pressure on prices, margins, and market share. Green Thumb faces competition from both large multi-state operators (MSOs) and smaller, regional players. To maintain its competitive edge, the company needs to continue innovating, developing differentiated products, and building strong brand recognition.

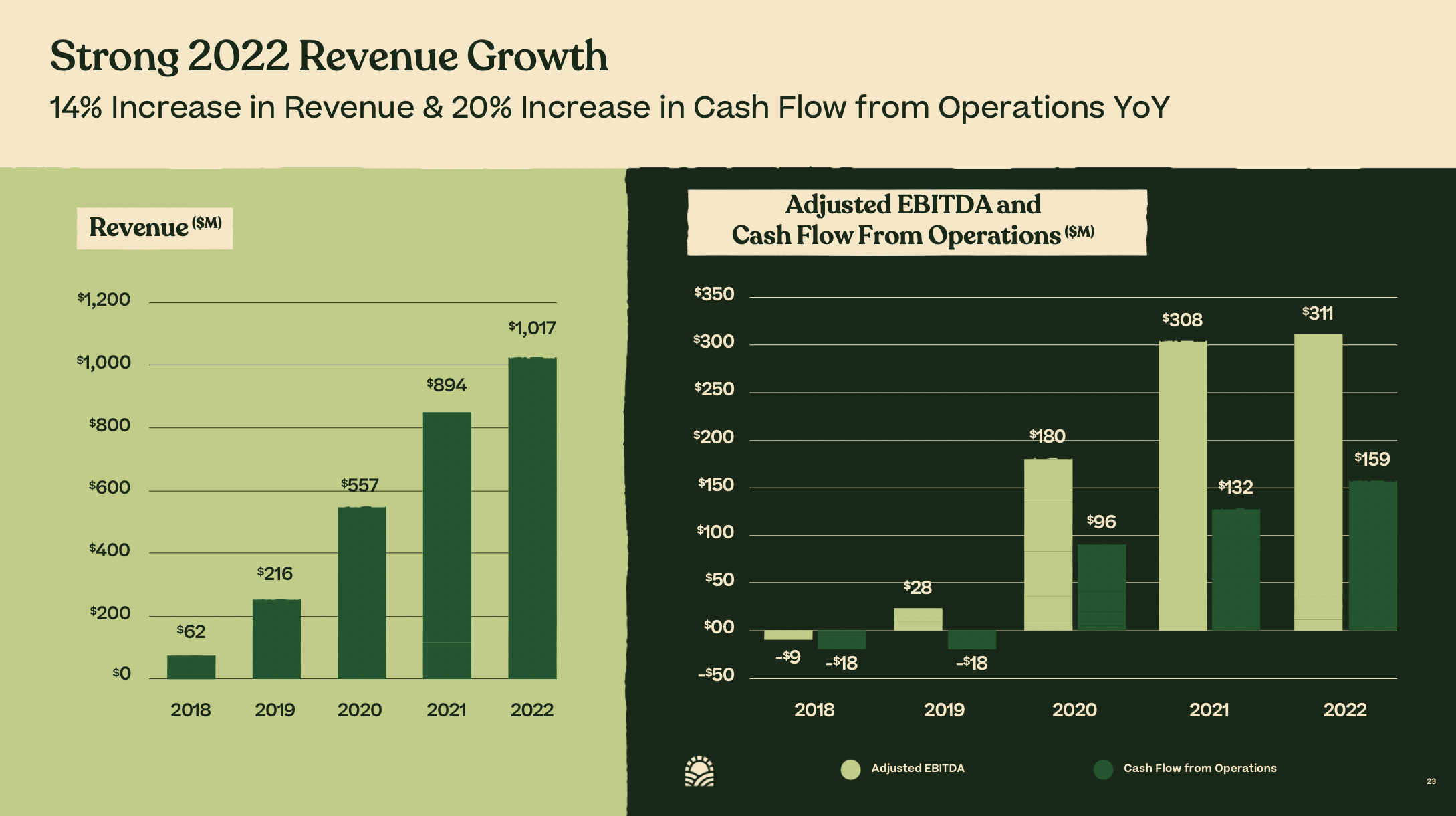

Capital Expenditures and Expansion

Green Thumb Industries has been actively expanding its operations, investing in new cultivation facilities, retail stores, and processing capabilities. While expansion is essential for long-term growth, it also requires significant capital expenditures. These investments can strain the company's financial resources and impact short-term profitability. Investors are closely watching the company's ability to effectively manage its capital expenditures and generate a return on its investments.

Debt Levels

Like many cannabis companies, Green Thumb Industries has accumulated debt to fund its expansion plans. While debt can be a useful tool for growth, high debt levels can also create financial risk. The company's ability to service its debt obligations is a key concern for investors. Rising interest rates can further exacerbate the burden of debt, making it more expensive to borrow and potentially impacting profitability.

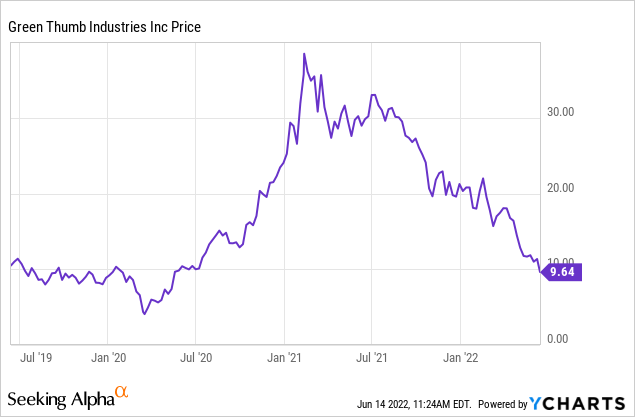

Investor Sentiment and Market Perception

Investor sentiment and market perception can significantly influence a stock's price, regardless of the underlying fundamentals. The cannabis industry has experienced periods of both euphoria and skepticism, and current market sentiment is somewhat cautious.

Lack of Federal Legalization

The continued lack of federal legalization in the United States remains a major overhang on the cannabis industry. Federal legalization would unlock significant opportunities for cannabis companies, including access to traditional banking services, the ability to list on major stock exchanges, and the elimination of certain tax burdens. The uncertainty surrounding the timing and likelihood of federal legalization creates hesitation among some investors.

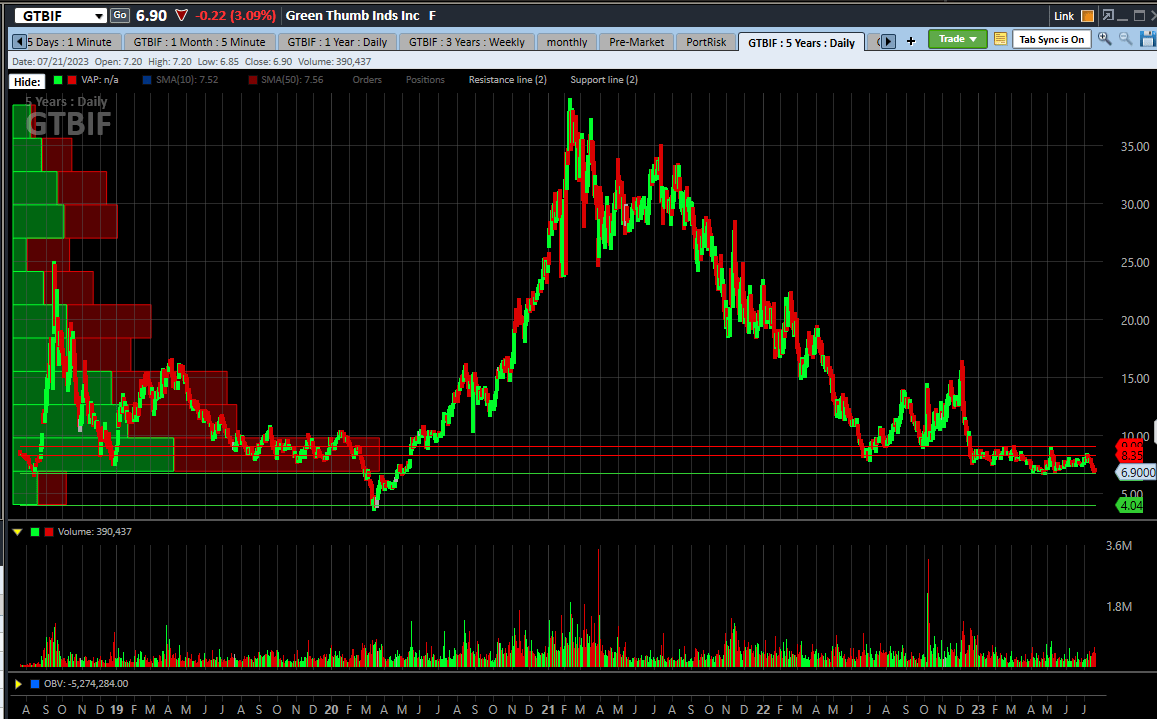

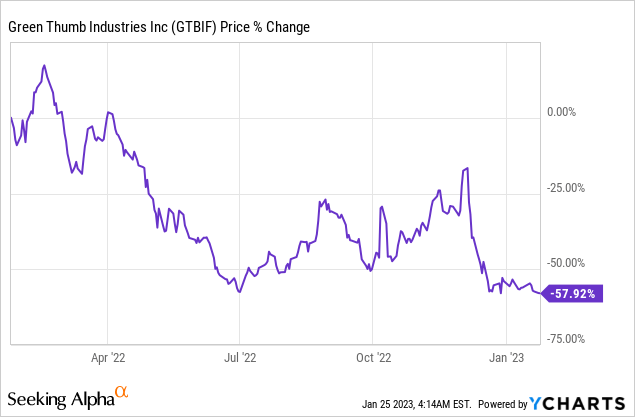

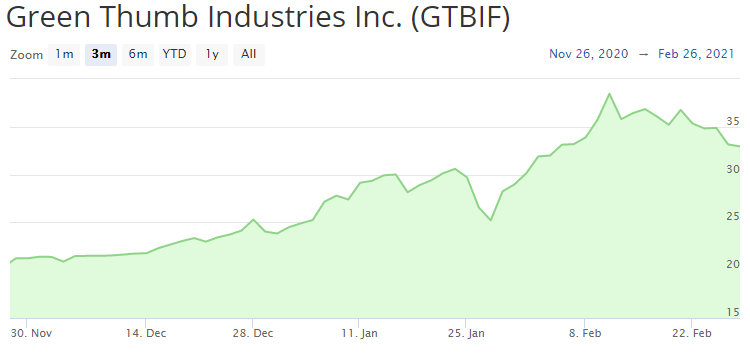

Changing Investor Appetite

Investor appetite for cannabis stocks has fluctuated over time. In the early days of legalization, there was significant enthusiasm and speculative investment. However, as the industry has matured and faced challenges, investor sentiment has become more discerning. Investors are now more focused on companies with strong fundamentals, proven track records, and clear paths to profitability.

Negative News and Events

Negative news and events, such as regulatory setbacks, product recalls, or disappointing earnings reports, can negatively impact investor sentiment and trigger sell-offs in cannabis stocks. The cannabis industry is particularly susceptible to these types of events, given the complex regulatory environment and the evolving nature of the market.

Specific Examples Related to Green Thumb Industries

While the above mentioned points are general, it's useful to consider them applied to Green Thumb Industries specifically.

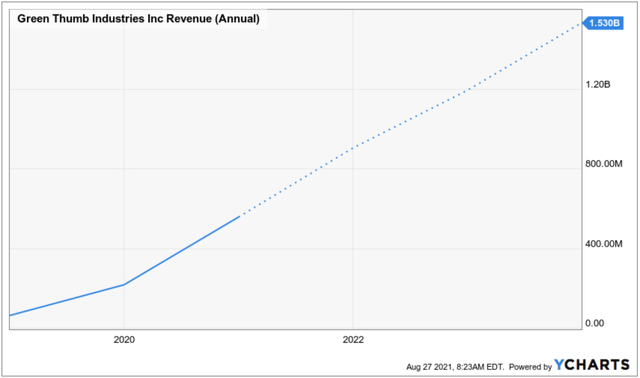

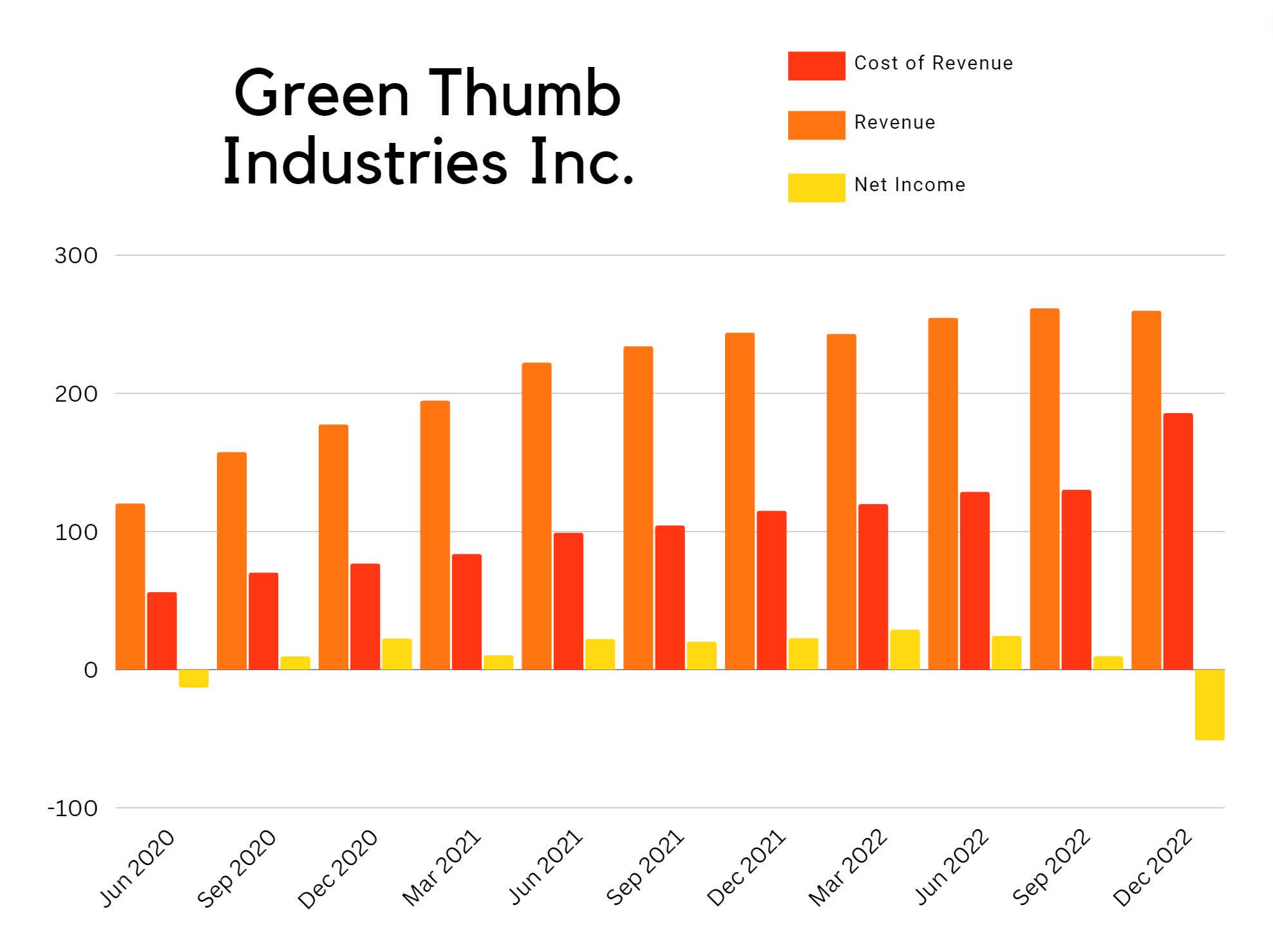

Financial Performance Metrics

Analyzing Green Thumb's financial statements provides valuable insights. Gross margins, operating expenses, and net income figures are crucial for assessing profitability trends. Investors will pay close attention to whether these figures are improving, stagnating, or declining, as this directly impacts the stock price. Also important are revenue growth rates and how they compare to competitors.

Expansion Strategy and Execution

Green Thumb's strategy revolves heavily around expanding both its retail footprint and cultivation capacity. Any hiccups in their expansion execution can spook investors. This includes delays in opening new stores or unforeseen challenges in scaling cultivation. Careful monitoring of expansion plans is vital in understanding stock fluctuations.

Market Share Data

Investors look closely at market share reports to determine Green Thumb's competitive position. Gains in market share indicate strong performance, while losses can raise red flags. Data is often segmented by state, offering a granular view of Green Thumb's performance across various markets.

Summary: Why This Matters

Understanding the factors contributing to Green Thumb Industries' stock decline is crucial for investors, industry analysts, and anyone interested in the cannabis market. The challenges facing the company are a combination of industry-wide headwinds, such as oversupply, regulatory hurdles, and macroeconomic factors, as well as company-specific issues related to profitability, competition, and capital expenditures. Moreover, investor sentiment and the lack of federal legalization continue to weigh on the cannabis sector. By analyzing these factors, investors can make more informed decisions about their investments, and industry observers can gain a deeper understanding of the dynamics shaping the cannabis market. The health of companies like Green Thumb is a barometer for the overall cannabis industry and understanding their challenges helps gauge the industry's current state and future trajectory.

![How to Buy Green Thumb Industries Stock [2025] | Step-by-step - Why Is Green Thumb Industries Stock Falling](https://assets.finbold.com/uploads/2024/01/How-to-Buy-Green-Thumb-Industries-stock-2-768x512.jpg)