WyHy Federal Credit Union is a financial institution headquartered in Casper, Wyoming. It serves members throughout the state, offering a range of banking products and services. This overview details WyHy's structure, history, offerings, and community involvement.

WyHy Federal Credit Union: Structure and Membership

WyHy operates as a not-for-profit financial cooperative. This means it is owned and controlled by its members, not by external shareholders. Any profits generated by the credit union are returned to the members in the form of lower fees, better interest rates on savings accounts, and more favorable loan terms.

To become a member of WyHy Federal Credit Union, individuals typically must meet certain eligibility requirements. These requirements may include:

- Living, working, worshipping, or attending school in Wyoming.

- Being an employee of a select employee group (SEG) affiliated with WyHy.

- Being related to an existing WyHy member.

The specific requirements can vary, so it is always best to check directly with WyHy to confirm eligibility.

Membership Benefits

Membership in a credit union like WyHy offers several potential advantages:

- Lower Fees: Credit unions often charge lower fees than traditional banks.

- Better Interest Rates: They may offer higher interest rates on savings accounts and lower rates on loans.

- Personalized Service: Credit unions are known for providing more personalized customer service.

- Community Focus: They tend to be more involved in the local community.

- Member Ownership: As a member, you have a say in how the credit union is run.

History of WyHy Federal Credit Union

WyHy Federal Credit Union has a long history in Wyoming. It was originally established to serve a specific group of employees, reflecting the common origins of many credit unions. Over time, WyHy expanded its membership base to include a broader range of individuals and organizations within the state.

The credit union's name, WyHy, is a shortened form referencing its origins but is also meant to represent the connection to the state of Wyoming. The credit union’s historical evolution reflects the changing needs of its members and the broader financial landscape.

Example: WyHy likely started as a small organization focused on providing basic financial services to a limited group of people. As the credit union grew, it added new products and services, expanded its branch network, and adopted new technologies to better serve its members.

Products and Services Offered

WyHy Federal Credit Union offers a comprehensive suite of financial products and services to meet the diverse needs of its members. These offerings typically include:

- Checking Accounts: Various checking account options, including those with no monthly fees, interest-bearing accounts, and accounts with overdraft protection.

- Savings Accounts: Savings accounts, money market accounts, and certificates of deposit (CDs) with competitive interest rates.

- Loans: A wide range of loan products, including auto loans, mortgage loans, personal loans, and business loans.

- Credit Cards: Credit cards with various rewards programs and features.

- Online and Mobile Banking: Convenient online and mobile banking platforms for managing accounts, paying bills, and transferring funds.

- Financial Planning: Access to financial planning services to help members achieve their financial goals.

- Insurance Products: Some credit unions offer or partner with insurance providers to offer insurance products.

Specific products and services, as well as their terms and conditions, are subject to change. It is important to consult with WyHy directly for the most up-to-date information.

Loan Products in Detail

WyHy, like other credit unions, places a strong emphasis on providing loans to its members at competitive rates. This includes:

- Auto Loans: For purchasing new or used vehicles.

- Mortgage Loans: For buying a home or refinancing an existing mortgage.

- Personal Loans: For a variety of purposes, such as debt consolidation or home improvements.

- Business Loans: For small businesses to finance their operations or expansion.

The interest rates and terms on these loans will depend on factors such as the borrower's credit score, loan amount, and repayment term.

Community Involvement

WyHy Federal Credit Union is actively involved in the communities it serves. This involvement may include:

- Financial Literacy Programs: Offering workshops and resources to help individuals improve their financial knowledge and skills.

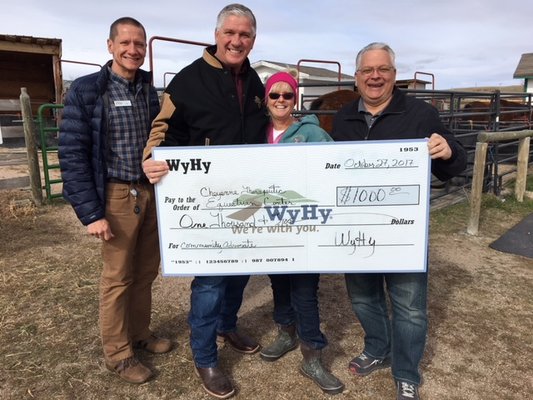

- Charitable Donations: Supporting local charities and organizations through donations and sponsorships.

- Volunteerism: Encouraging employees to volunteer their time to local causes.

- Scholarships: Providing scholarships to students pursuing higher education.

- Community Events: Participating in local events and festivals.

This community focus reflects the credit union's commitment to making a positive impact on the lives of its members and the broader community.

Example: WyHy might sponsor a local youth sports team, donate to a food bank, or host a free financial literacy workshop for seniors. These activities demonstrate the credit union's dedication to giving back to the community.

Technology and Innovation

WyHy Federal Credit Union recognizes the importance of technology in today's financial landscape. It offers a range of digital banking services to provide members with convenient access to their accounts and financial tools. These services may include:

- Online Banking: Accessing accounts, paying bills, transferring funds, and viewing statements online.

- Mobile Banking: Managing accounts and performing transactions using a mobile app.

- Mobile Deposit: Depositing checks remotely using a smartphone.

- Online Loan Applications: Applying for loans online.

- Digital Wallets: Using digital wallets like Apple Pay or Google Pay.

WyHy continues to invest in technology to enhance the member experience and provide innovative financial solutions.

Practical Advice and Insights

Considering a credit union like WyHy for your banking needs can be a beneficial decision. Here's some practical advice:

- Compare Rates and Fees: Always compare the interest rates and fees offered by different financial institutions before making a decision.

- Check Membership Eligibility: Ensure you meet the eligibility requirements to become a member of WyHy.

- Explore Products and Services: Review the range of products and services offered by WyHy to see if they meet your needs.

- Consider the Community Focus: If supporting a local, community-focused financial institution is important to you, a credit union may be a good choice.

- Take Advantage of Digital Banking: Utilize the online and mobile banking services to manage your accounts conveniently.

- Get Involved: Consider attending annual meetings or volunteering with the credit union to have a voice in its operations.

Ultimately, the best financial institution for you will depend on your individual needs and preferences. WyHy Federal Credit Union offers a viable option for those seeking a member-owned, community-focused financial institution in Wyoming.